Rates, Charges, Fees, and Taxes on Appointments & Agreements

If you've made rates available for certain types of appointments and agreements and set up those rates, a Select Rate section is available on the appointment and agreement for you to apply a rate.

Once a Rate Code and Model Group are selected, the Charges grid is displayed, containing the following charges, as applicable:

- Hourly, daily, weekly, and/or monthly rate charges applicable based on 1) the length of the appointment or agreement, 2) the date range, if you have date-based rate pricing, and 3) rate setup items. See "Rates and Charges" for more information.

- Fuel charge (if a gas vehicle was assigned)

- Mileage charges (at close)

- Fees

- Surcharges

- Taxes

Hover to view the full-sized image.

Setup Requirements

This is a quick reference walkthrough. See "Rates, Charges, Fees & Taxes Setup" for full, detailed instructions.

- Turn on rates for your Agreement Types (e.g., Rental rates, etc.) Use the Agreement Types setting to enable rates for types of agreements used at your location. For example, for rental rates, turn on the Rental Service and Enable Rates Charges. (Some manufacturers may require TSD Support to perform this step.)

- Have TSD turn on external booking. For API customers / manufacturers that expose rates on a website, TSD support must configure this feature using the Expose Externally setting. Note: This feature is a sold separately. Contact your TSD Sales Representative at sales@tsdweb.com for more information.

- Create Model Groups. Edit the Model Groups setting to create Model Groups, if you want one rate for all models or different rates for different model groups (e.g., SUVs, Sedans, etc.).

- Set up a Mileage Charge if you plan to charge customers for miles driven on an agreement.

- Set up Rental, Loaner, and/or Test Drive rates. Edit the appropriate setting to set up rates for a type of agreement: Rental Rate Setup (for Rental agreements), Loaner Rate Setup (for Loaner agreements), and/or Test Drive Rate Setup (for Test Drive agreements). Add rates by doing the following:

- Create Rate Codes for different types of rates. You can make rates applicable for a certain date range. So, instead of setting up a rate that is valid for its entire existence (until it is either updated or removed), the amount of the rate can vary depending on the time of year.

- Choose whether a Mileage Charge will apply, or whether unlimited miles will be offered. On the Taxes Exempt tab, decide which taxes do not apply to the Rate Code.

- Add hourly, daily, weekly, and monthly rate amounts, as needed.

- For manufacturers that expose rental or loaner rates on a website, expose the Rate Codes to be made available via the online services. Note: This feature is a sold separately. Contact your TSD Sales Representative at sales@tsdweb.com for more information.

- Use the Rate Thresholds Configuration settings to define thresholds for daily, weekly, and monthly rates.

- Set up a Fuel Charge if you plan to charge a per-gallon rate for fuel.

- Set up taxes using the Taxes Setup setting. Apply taxes to rates, fuel, and mileage, as needed.

- Set up surcharges that apply to rate charges using the Surcharge setting, if needed. Apply taxes to the surcharge, as applicable.

- Review and add fees using the Fees Setup setting.

- Adjust the amount and frequency, if applicable.

- Review whether the fee should auto-apply to agreements.

- For manufacturers that expose rates on a website, you can expose the fee externally to make it selectable on a website. Note: This feature is a paid module.

- Select taxes that apply to the fee.

Rates and Charges

Note: On Rental appointments and agreements, selecting a rate is required in order to complete (save) the record.

Hover to view the full-sized image.

- If viewing an opened agreement or booked appointment, edit (

) the Rate Information section. Otherwise, after a date range is selected on the appointment or agreement, select a Rate Code and Model Group, if necessary, to display the hourly, daily, weekly, and/or monthly rates associated with your selections.

- After a rate is selected, the Charges grid is displayed with:

- the applicable hourly, daily, weekly, and/or monthly rates that apply to the agreement. See "Rates and Charges" for more information.

- any fees set up to auto apply to agreements.

- fuel (if applicable, for gas vehicles) and mileage charges, unless the Rate Code offers unlimited miles. See "Set up a Mileage Charge" for more information.

- After you assign a unit, your Rate Code and Model Group selections are unchanged, even if the unit is not within the selected Model Group.

Note: If your location only has a single Model Group or Rate Code set up for this type of appointment or agreement, TSD DEALER automatically selects it for you.

Your employee role must have the Allow Modify Agreement Rate permission to edit rate, fuel, or mileage charges on appointments and agreements.

You can edit a rate, fuel charge, or mileage charge amount when creating an appointment, or when opening or closing an agreement. You cannot edit rates or charges after a payment is processed, for locations with Credit Card and Payment Processing, or after the agreement is closed.

- In the Charges grid, click the edit icon (

) next to the rate or charge.

- Adjust the amount and click .

If your location charges rates for appointments and agreements, calculations of these hourly, daily, weekly, or monthly rates, if set up, are determined by all of the following factors:

- Billing Type of the Rate Code being applied. The Billing Type of a Rate Code determines:

- How days are incremented when it comes to rates: every 24 hours, starting from the checkout time, or each Calendar day at midnight.

- Whether hourly, weekly, or monthly rates apply; these can only be set up for 24-hour Rate Codes

- Whether Rate Thresholds are considered, as these are only applicable for 24-hour billing types of rate codes. For Rate Codes with a 24-hour billing type, the Rate Thresholds Configuration setting defines:

- the number of hours at which an agreement becomes eligible for a daily rate (e.g., 24 hours).

- the number of days at which an agreement becomes eligible for a weekly rate (e.g., 7 days).

- the number of days at which an agreement becomes eligible for a monthly rate (e.g., 30 days).

- Length of the appointment or agreement. This is displayed as the Total Days, after selecting a Checkout Date and Return Date. The number of days for which a rate applies is also shown in the Charges grid.

- The Checkout Date, if you have date-based rate pricing.

Rate calculation scenarios

In all examples: the follow Rate Threshold bumps apply:

- Hours Until Daily Rate = 24 hours

- Days Until Weekly Rate = 7 days

- Days Until Monthly Rate = 28 days

Example #1. A Rate Code with a Billing Type of 24-hours is applied to an agreement. This Rate Code contains a $5 hourly rate, a $30 daily rate, a $150 weekly rate, and a $600 monthly rate.

- If the agreement's duration is February 23rd, 12:00PM to February 24th, 9:00AM (1 Total Days; 23-hours long), the rate charges will amount to $115.00. Because this agreement is under 24-hours long and hasn't met the length threshold to apply the daily rate, the $5 hourly rate is applied for each of the 23 hours.

- If the agreement's duration is February 23rd, 12:00PM to February 24th, 4:00PM (2 Total Days; 28-hours long), the rate charges will amount to $50.00. The $30 daily rate is applied for one 24-hour day, plus the $5 hourly rate for each of the remaining 4 hours.

- If the agreement's duration is February 23rd, 12:00PM to March 2nd, 12:00PM (8 Total Days), the rate charges will amount to $160.00. The $150 weekly rate is applied for the first seven 24-hour days, plus the $5 hourly rate for each of the remaining 2 hours.

- If the agreement's duration is February 23rd, 12:00PM to March 24th, 12:00PM (29 Total Days), the rate charges will amount to $630. The $600 monthly rate is applied for the first 28 days, plus the $30 daily rate for the remaining day.

Example #2: A Rate Code with a Billing Type of Calendar is applied to an agreement. This Rate Code contains a $30 daily rate.

- If the agreement's duration is from February 23rd, 12:00PM to February 24th, 9:00AM (1 calendar day long), the rate charges will amount to $30. The $30 daily rate is applied for one calendar day.

- If the agreement's duration is from February 23rd, 12:00PM to February 24th, 4:00PM (2 calendar days long), the rate charges will amount to $60.00. The $30 daily rate is applied for two calendar days, incremented at midnight.

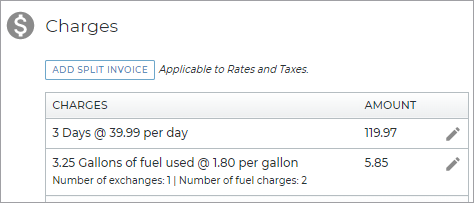

If your location charges for fuel for gas vehicles in your fleet, the default Fuel Charge setting determines the default cost of fuel, per gallon.

Note: Electric vehicles do not generate fuel charges, so if you have fuel charges set up, this charge is only applied if a gas vehicle was assigned to the agreement, and is only applicable for the gas consumed, not the electric vehicle's battery.

When returning a unit during an exchange or close agreement, fuel charges are calculated based on the unit's Fuel Level Out, Fuel Level In and Fuel Capacity (tank size), with Free Fuel taken into account, if offered. If the unit is returned with less fuel than it had when it went out (Fuel Level Out > Fuel Level In), fuel charges are calculated based on the difference and the fuel capacity, and any free fuel consumed is reflected in the discounted number of gallons or liters in the Charges grid.

For example, if you offer 1/4 gallon of free fuel and the total fuel consumed on the agreement (including on units exchanged) is 1/4 gallon, then the Charges grid shows 0.00 gallons of fuel used and a charge of $0.00. If 1/2 gallon was consumed, then the Charges grid shows only 1/4 gallons of fuel used, since the other 1/4 gallon was free.

Example: You set up a default fuel rate of $1.80 per gallon. A unit went out with a full 13-gallon tank but was returned with 3/4, so 1/4 of fuel (3.25 gallons) was consumed. At $1.80 per gallon, a fuel charge of $5.85 would be applied. If, say, 1/4 a tank of free fuel is offered on your agreements, then no fuel is shown in the Charges grid as having been used.

If your location charges for mileage, the Mileage Charge and Free Miles/KM, as well as the Fuel Level Out and Fuel Level In, determine the mileage charges calculated at close agreement.

Some Rate Codes offer unlimited miles, which means Mileage Charges are not applied to agreements with that Rate Code selected. Otherwise, your per-mile Mileage Charge will be applied based on the number of miles driven on the agreement.

More specifically, the calculation for chargeable miles is: [Total miles driven by all units on an agreement] - [total number of free miles]. The calculation for mileage charges is: Chargeable miles * Mileage Rate.

So, if you offer 100 free miles per calendar day, an agreement spanning 2 calendar days offers a total of 200 free miles. Additional miles that exceed this threshold are charged the per-mile rate.

Additional Fees

Your employee role must have the Opt-Out of Charges permission to add fees, and the Allow Modify Agreement Rate permission to edit and remove fees.

Fees that are set up to auto-apply to appointments and agreements are automatically displayed in the Charges grid. If your location uses rates, Daily fees are incremented based on the Billing Type (24-hour or Calendar) of the Rate Code applied to the appointment or agreement. See "Set Up Additional Fees" for more information.

Your employee role must have the Opt-Out of Charges permission to add fees.

You can apply a fee anytime during the appointment or agreement process, as well as after an agreement is closed.

- In the Fees section of the Charges grid, click the add icon (

) to view a list of your location's fees not already applied to the agreement.

) to view a list of your location's fees not already applied to the agreement. - Select the check boxes (

) for the fees you want to apply.

) for the fees you want to apply. - Click .

Your employee role must have the Allow Modify Agreement Rate permission to edit and remove fees.

You can edit a fee amount when creating an appointment, or when opening or closing an agreement, as long as a payment hasn't already been processed for the fee (for locations with Credit Card and Payment Processing).

If you add a fee after closing the agreement, you can edit that fee amount before a payment has been processed for the fee.

- In the Fees section of the Charges grid, click the edit icon (

) next to the fee.

- Adjust the amount and click .

Your employee role must have the Allow Modify Agreement Rate permission to edit and remove fees.

You can remove a fee any time during the appointment or agreement process, before the agreement is closed, as long as a payment hasn't already been processed for the fee.

If you add a fee after closing the agreement, you can remove that fee before a payment has been processed for the fee.

To remove a fee that has been applied to an appointment or agreement, in the Fees section of the Charges grid, click the remove icon (

Taxes and Surcharges

How are taxes calculated?

If your location has percentage taxes set up, the tax is calculated as a percentage of the following total charges:

- Rate charges, fuel charges, and mileage charges, depending on how you've set up the tax.

- Certain fees, depending on how you've set up fees. (For example, if you want a Detail Fee to be taxed only by your state and sales taxes.)

- Certain surcharges, depending on how you've set up your surcharges

If you've set up a flat tax, that tax amount is applied once each day of the agreement, as long as a rate has been applied to the agreement. For example, if you set up a $2.00 Flat Daily tax, an agreement with a length of three (3) days would accrue $6.00 in flat taxes.

However, if you have any tax exemptions added to a Rate Code, the tax does not apply to the agreement at all, if that Rate Code is selected.

How are surcharges calculated?

If your location has one or more surcharges set up, the percentage is applied against the appointment or agreement's total rates charges only, not fuel or mileage or any other charges. So, if you have a 3% surcharge set up, and an agreement of three (3) days at $30.00 a day amounts to $90 in rate charges, then the surcharge amount applied will be 3% of $90, or $2.70.

If the surcharge is set up to be subject to one or more of your taxes (e.g., a sales tax), then those taxes will apply to the surcharge.

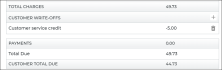

Write Offs

When closing an agreement, you can waive an amount due from the customer's bill with a write off. For example, let's say the customer owes $150, but the repair took an extra day and you want to write off $20 as a customer satisfaction credit. The total amount due by the customer would be $130.

Write Off Rules: ![]() Read More

Read More

Your employee role must have the Add Write Offs permission to add write offs.

- In the Customer Write Offs section of the Charges grid, click the Add icon

().

- Add the amount to write off, up to the customer amount due, and enter a reason for the write off, up to 50 characters.

- Click .

Hover to view the full-sized image.

The Write Off (as a negative value) is included in the Charges grid. While the Total Charges will still show the total amount in charges on the bill, the Customer Total Due will be adjusted to reflect the subtracted amount on Charges grid and on the invoice.

- Click the Delete button (

) in the Charges grid, next to the write off.

- The Write Off amount is removed from the customer portion of the bill.

Write offs are included on the Closed Contract Accounting Report, and in Custom Reports.

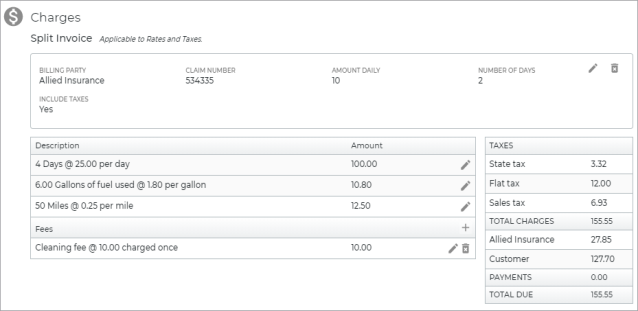

Split Invoices with Billing Companies

When only a daily rate is applied to agreement charges, an button is available for cases when a third party company, such as an insurance company, is responsible for some or all of the agreement's daily rate charges, and, if you choose, taxes on its portion of the rate charges. That way, you can generate two invoices: one to send to a billing company, and to provide to the customer (driver).

Note: If a customer write off is present, you must remove the write off before splitting the invoice, then add the write off. Additionally, you can only split an invoice if the Rate Code applied to the agreement contains only a daily rate. If hourly or weekly rates are present in the Rate Code, the button is unavailable.

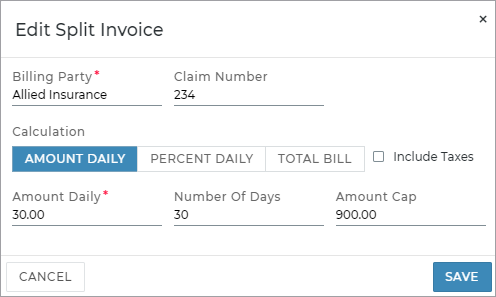

- Next to the Charges grid, click .

- On the Edit Split Invoice dialog, enter the name of the Billing Party company responsible for covering some or all of the rate charges.

- Choose whether the Billing Party company is paying:

- Amount Daily: a daily flat amount of the rate charges (e.g., up to $20.00 a day); the company will not be responsible for taxes unless Include Taxes is selected.

- Percent Daily: a daily percentage of the rate charges (e.g., 10% a day); the company will not be responsible for taxes unless Include Taxes is selected.

- Total Bill: the entire bill, including all applicable fuel and mileage charges, fees, and taxes; the company will not be billed for toll violations incurred on the agreement, for locations with Toll Processing. (These are either charged to the customer's card, or the dealership.)

- If the company is paying a portion of the rate charges (Amount Daily or Percent Daily):

- Enter the Amount Daily or Percent Daily, as applicable.

- Select Include Taxes if the company is to be responsible for taxes on its portion of the rate charges; if cleared, the customer will be responsible for all taxes.

- (Optional) The following additional fields are available, if necessary:

- Claim Number, to add a claim number

- Number of Days for which the rate is being billed to the company (e.g., 5 days).

- Amount Cap, or the maximum amount of rate charges to be billed to the company (e.g., $200). The company amount due will not exceed this amount.

- Click . The Charges grid is updated to reflect charges billed to the customer, and charges billed to the company Billing Party.

- After the agreement is closed, you can print a company invoice on the closed agreement. See "Print or email an invoice".

See "Amount Daily, Percent Daily, or Total Bill (Split Invoice)" in the glossary for more information about these billing options.

See "Glossary of terms" in this topic for more information about these fields.

Example: An insurance company may be covering up to a daily flat amount of up to $30.00, for a maximum number of 30 days, at a cap of $900, excluding taxes. Enter 30.00 in the Amount Daily field, 30 in the Number of Days field, and $900.00 as the Amount Cap, and leave the Include Taxes check box cleared.

Example: If an insurance company will pay $25.00 per day for 10 days, up to a maximum amount of $250, enter 25.00 in the Amount Daily field, 10 in the Number of Days field, and $250.00 as the Amount Cap.

You can remove a billing company from a split invoice anytime during the agreement process, including after the agreement is closed, regardless of whether a payment has already been processed (for locations with Credit Card and Payment Processing).

- In the Split Invoice section, click the delete icon (

) next to the Split Invoice information to delete the company from the invoice.

- The Charges grid, customer invoice (if applicable), and amount due from the customer are updated accordingly.

After the agreement is closed, you can print or email a bill-to company invoice, containing only those charges and taxes billed to the company. See "Print or email an invoice".

Credit Card Processing & Payments

TSD DEALER's Credit Card Processing integration with TSD Connect is available at no additional charge; Toll Processing is sold separately. Contact your TSD Sales Representative at sales@tsdweb.com to get started.

With TSD DEALER's Credit Card and Payment Processing integration, you can securely collect a customer's credit card and bill for any ancillary charges, such as rates, fuel, and toll violation charges (if your location also uses Toll Processing), all without hassle. See "Credit Card Processing" for more information.

For locations that use Credit Card and Payment Processing with TSD Connect integration, the following options may be available:

- Add or change a credit card using the button, and save the card so it can be used for the customer in the future. See "Capture a Credit Card" for more information.

- Take a pre-authorization on a card to reserve funds for agreement charges and, if applicable, for future toll charges; pre-authorizations are available with certain providers. See "Take a Pre-Authorization" for more information.

- Process a payment against a customer's card, at close agreement. See "Take a payment at close agreement" for more information.

- Bill a customer for toll charges incurred on the agreement, if your location also uses Toll Processing. See "Credit Card Processing for Tolls".

Invoices

You can generate an invoice for charges billed to a customer and/or charges billed to a company (for split invoices) after an agreement is closed, in the Charges section of the agreement.

- Click or .

- If this is a split invoice, select the customer or company invoice, or choose Print All / Email All to print / email each invoice on its own page.

- If emailing, verify the email address, if different than the one used on the agreement.

- Click (if printing) or (if emailing).

Reporting on Charges

The Closed Contract Accounting report contains revenue in rates, tolls, fuel charges, mileage charges, fees, and taxes you are generating from closed agreements. See "Closed Contract Accounting Report" for more information.

Glossary of terms

Amount Cap (Split Invoice)

When creating a split invoice (Amount Daily or Percent Daily), you have the option to impose a cap on company charges by entering an Amount Cap. This is the maximum amount of rate charges to be billed to the Billing Party company, so the company amount due will not exceed this amount. For example, if an insurance company will pay 80% of the bill up to $200.00, enter $200.00 as the Amount Cap.

Amount Daily, Percent Daily, or Total Bill (Split Invoice)

When creating a split invoice, you have three options for how the Billing Party company will pay rate charges:

- Amount Daily. Select this option if the company is paying a flat amount of the rate charges; specify the amount that the company will pay in the Amount Daily field. For example, if an insurance company will pay $25.00 of the rate charges, select the Amount Daily option and enter 25.00.

- Percent Daily. Select this option if the company is paying a percentage of the rate charges; specify the percentage that the company will pay in the Percent Daily field. For example, if an insurance company will pay 80% of the rate charges, select the Percent Daily option and enter 80.

- Total Bill: Select this option if the company will be responsible for the entire bill (in other words, the Total Due amount), including all applicable fuel charges, fees, and taxes. For locations using Toll Processing, if violations are incurred on the agreement, these will not be included in the amount covered by a company. Toll violation charges, if present, are charged to the customer or location, based what is selected on the agreement.

You can use the optional Number of Days field to specify the number of days for which the company will pay a daily amount or percentage. For example, if an insurance company will pay a daily amount of $25.00 for two (2) days, the company will pay up to a total of $50.00, depending on how long the agreement lasts.

Billing Party (Split Invoice)

When creating a split invoice, the Billing Party is the name of the third party (for example, an insurance company), responsible for covering some or all of the rate charges.

Claim Number (Split Invoice)

When creating a split invoice, you can enter a Claim Number.

Include Taxes (Split Invoice)

When creating a split invoice (Amount Daily or Percent Daily), select the Include Taxes check box if the company is responsible for taxes on its portion of the rate charges; if cleared, the customer will be responsible for all taxes.

Example: If a 6.25% sales tax is applied to a 2-day agreement with a daily rate of $25, and the company is responsible for covering a daily amount of $10 for two days, then the total Sales Tax on the bill would be $3.12, or 6.25% of $50. The company would be responsible for $1.25 in Sales Tax (6.25% of $20).

Number of Days (Split Invoice)

When creating a split invoice (Amount Daily or Percent Daily), you can use the Number of Days field if the company will pay a daily amount or percentage of rate charges for only a certain number of days (up to an Amount Cap, if specified).

Split Invoice

When only a daily rate is applied to agreement charges, an button is available for cases when a third party company, such as an insurance company, is responsible for some or all of the agreement's daily rate charges, and, if you choose, taxes on its portion of the rate charges. That way, you can generate two invoices: one to send to a billing company, and to provide to the customer (driver). See "Split Invoices with Billing Companies" for more information.

© 2026 TSD Rental, LLC